$1.5B AI Deal Underscores Abu Dhabi’s Need for Economic Intelligence

In 2024, Abu Dhabi made headlines with a $1.5 billion strategic investment from Microsoft into G42, a homegrown AI powerhouse. This landmark deal wasn’t just a win for capital inflow. It was a signal that Abu Dhabi’s economic future hinges on smart, data-driven decision-making. As the emirate accelerates its diversification away from hydrocarbons, Abu Dhabi Economic Intelligence is becoming a critical tool for tracking sectoral shifts, guiding investment strategy, and shaping policy with precision.

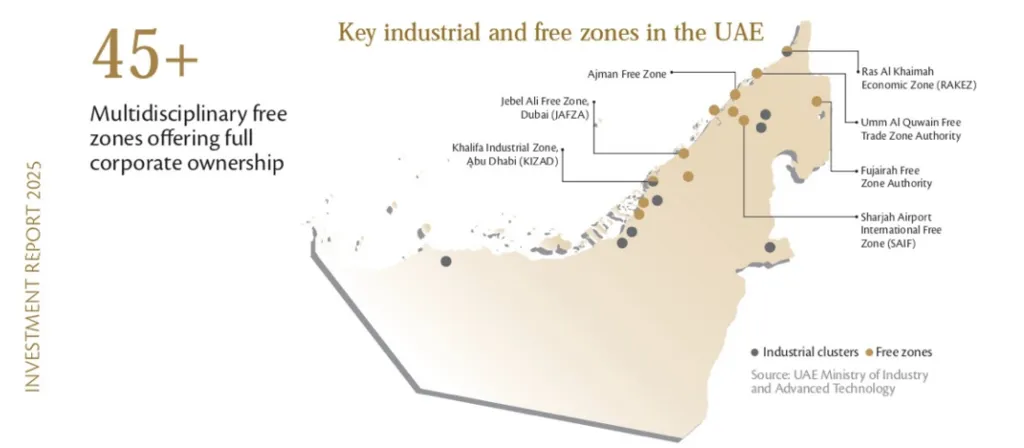

KIZAD and Free Zones: Localized Data Powers Strategic Growth

Abu Dhabi’s Khalifa Industrial Zone (KIZAD) is one of over 45 free zones across the UAE, but its role is uniquely strategic. Offering full foreign ownership, streamlined licensing, and proximity to global shipping routes, KIZAD is a magnet for advanced manufacturing and logistics. Yet, to optimize zone performance and attract the right investors, authorities increasingly rely on Abu Dhabi Economic Intelligence; from benchmarking incentives to analyzing sector-specific demand.

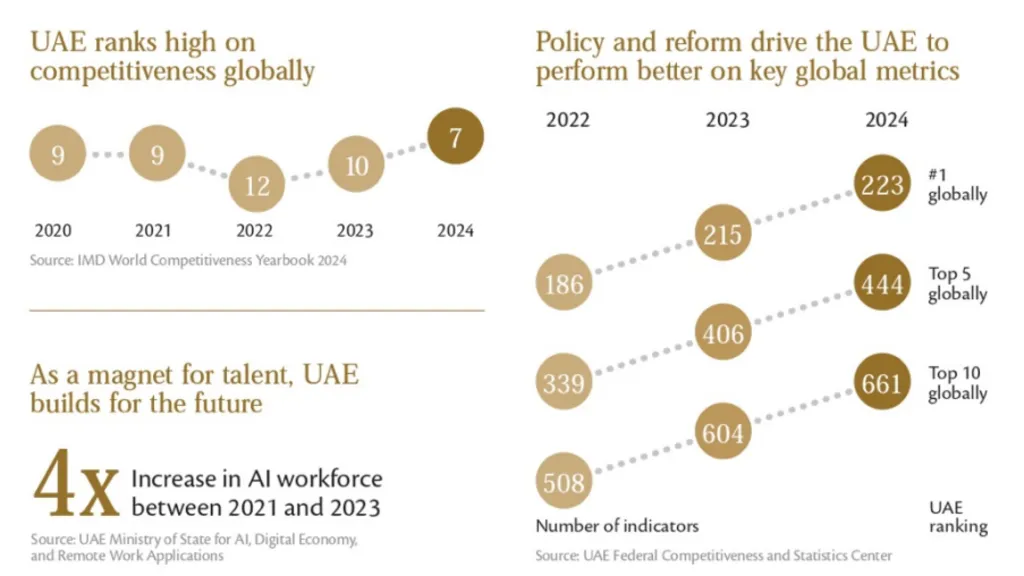

AI Workforce Quadruples: Talent Trends Demand Real-Time Insight

Between 2021 and 2023, the UAE's AI workforce grew fourfold, reflecting the emirate’s ambition to lead in emerging technologies. This rapid expansion requires more than just training programs. It demands intelligence on talent pipelines, R&D output, and global competitiveness. Economic intelligence platforms help track these dynamics, ensuring that workforce development aligns with sectoral priorities and long-term economic goals.

Project Finance and Industrial Strategy: Abu Dhabi’s Capital Blueprint

Abu Dhabi plays a central role in financing and executing strategic infrastructure projects such as the Barakah Nuclear Energy Plant and the Hafeet Rail corridor, both of which rely on international project finance to accelerate delivery. International project finance (IPF) has become a key mechanism for delivering complex, capital-intensive developments. Abu Dhabi Economic Intelligence enables stakeholders to assess project viability, monitor funding flows, and evaluate long-term returns. Especially in sectors like renewables, logistics, and petrochemicals.

Start-Up Capital and Sectoral Focus: Abu Dhabi’s Innovation Pulse

Although the UAE as a whole raised $1.1 billion in start-up capital in 2024, Abu Dhabi remains a dominant hub within that ecosystem, particularly in fintech, Web3, and healthtech. Localized economic intelligence helps track where capital is flowing, which sectors are scaling, and how policy can support emerging industries. This is especially vital as Abu Dhabi positions itself as a launchpad for regional and global innovation.

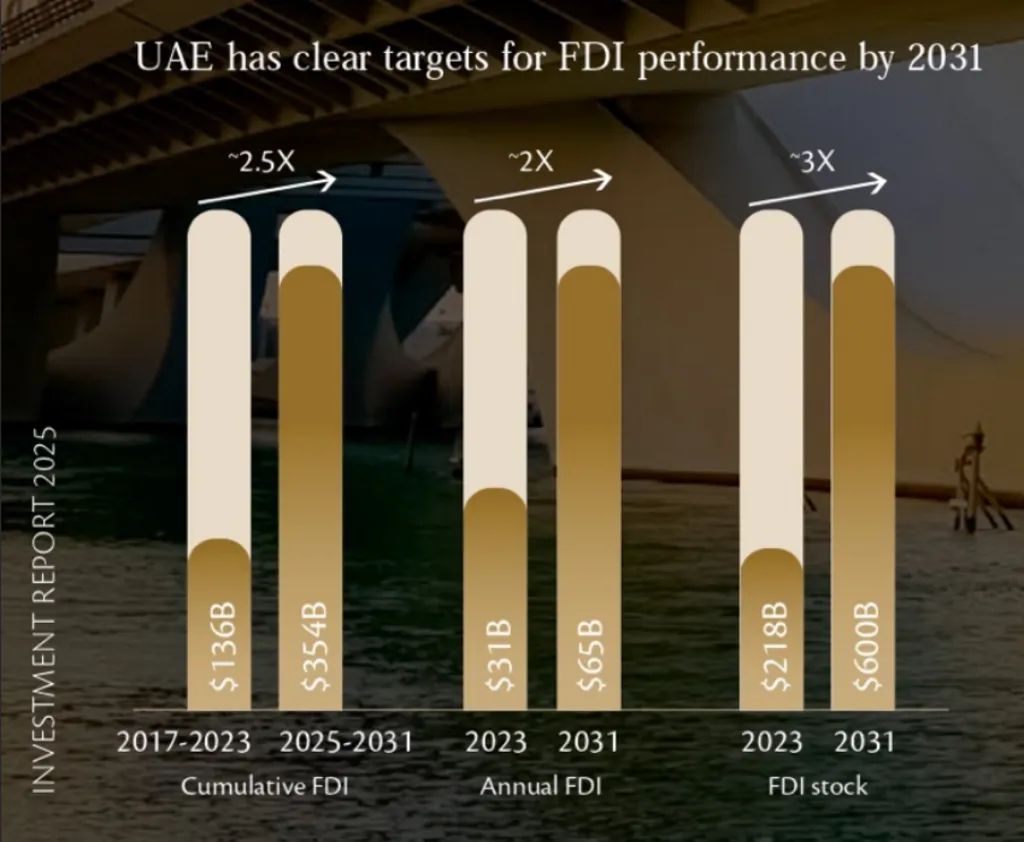

A Roadmap to 2031: Abu Dhabi’s Intelligence-Led Future

The UAE’s National Investment Strategy 2031 sets ambitious targets, including doubling annual FDI inflows and raising total FDI stock to $600 billion. Abu Dhabi is expected to play a pivotal role in achieving these goals. But to do so, the emirate must deepen its use of Abu Dhabi Economic Intelligence, not just to attract capital, but to deploy it wisely, measure impact, and adapt to shifting global dynamics.

Also Read: Abu Dhabi’s Billion-Dollar Hedge Fund Boom