The Abu Dhabi Falcon Economy has become a symbol of a new era in the emirate. What began as a heritage-driven sector now reflects the wider rise of global wealth flowing into Abu Dhabi. Falcon auctions, cultural tourism, and a surge in billionaire-led family offices at the Abu Dhabi Global Market (ADGM) together show how the city is reshaping its non-oil future. At ADIHEX 2025 alone, 325 falcons sold for Dh5.4 million, with a single bird reaching Dh350,000. These high-value events mirror the high-value investors who are now shifting their family offices into ADGM.

ADGM Expansion & the Abu Dhabi Falcon Economy Effect

ADGM is at the center of this transformation. Its assets under management jumped 226% in the first half of 2024, reaching USD 635 billion, with billionaire family offices such as those of Asif Aziz and Wafic Said choosing Abu Dhabi as their base. Operational entities within ADGM climbed to 2,088 by mid-2024, or a 31% year-on-year rise.

Regulatory upgrades have made ADGM a magnet for hedge funds. More than 161 fund managers now operate there, overseeing 220+ funds. With listed companies hitting a Dh500 billion market cap by 2025 and a $16 billion expansion underway, the district is preparing for more offices, more funds, and more luxury spaces.

This momentum mirrors the wider rise of the Abu Dhabi Falcon Economy, such as heritage, culture, and finance merging into a powerful investment story.

Read Also: Abu Dhabi’s Billion-Dollar Hedge Fund Boom

The Golden Visa Wave and the Luxury Ecosystem

The Golden Visa program has become a long-term driver of the luxury economy. Investors securing residency through AED 2 million property thresholds are transforming upscale neighborhoods like Saadiyat Island. Transactions above AED 2 million have climbed steadily since the program’s launch, fueling new construction, premium real estate projects, and a boom in high-end services.

Luxury hotels are also benefiting. Abu Dhabi reached 79.7% occupancy in 2024, with 26% RevPAR growth, signaling strong demand from high-net-worth visitors, executives, and newly relocated family office teams.

Sectors to Watch: Fintech and High-End Hospitality

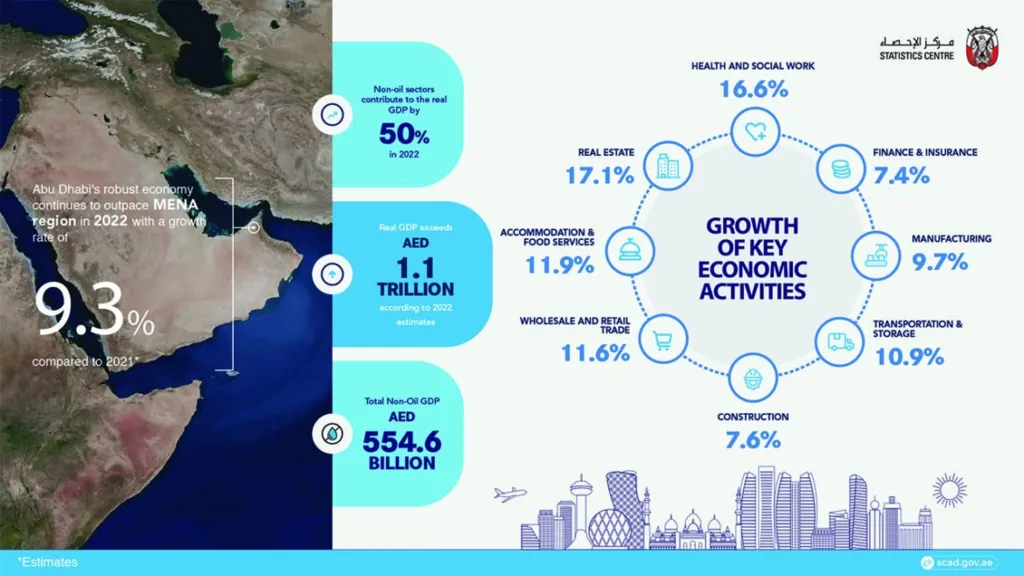

Two sectors stand out in the new wealth wave. Fintech continues to climb, supported by ADGM’s expanding regulatory environment. The financial sector grew 13.4%, reaching AED 22 billion, or 7.4% of Abu Dhabi’s GDP.

Next is the high-end hospitality, which is experiencing parallel momentum. Luxury hotels are filling rooms at near-record levels, supported by investors and families who want premium services, private education, and exclusive experiences.

Read Also: Quantum Capital: Abu Dhabi’s 2025 Finance Frontier

Why the Abu Dhabi Falcon Economy Matters Now

The Abu Dhabi Falcon Economy reflects more than cultural tradition. It captures the emirate’s power to attract global capital. Billionaires moving family offices into ADGM creates ripple effects across luxury real estate, hospitality, and education. This shift strengthens Abu Dhabi’s long-term non-oil strategy and positions the city as a global wealth hub. To explore how to navigate this evolving landscape and tap into regional growth opportunities, contact Market Research Abu Dhabi by Eurogroup Consulting. With 40 years of strategic consulting excellence and deep expertise in market research in Abu Dhabi, our team offers unmatched insights for organizations seeking success in fast-changing markets.