Supply Trails Demand in Abu Dhabi’s H1 2025 Market

Abu Dhabi’s real estate sector is entering a new era. One that is defined by strategic growth, rising demand, and a renewed focus on livability. The H1 2025 data by ADREC reveals a compelling narrative: the emirate’s residential market is thriving, yet supply is struggling to keep pace. This dynamic is reshaping the landscape of Abu Dhabi Living & Real-Estate Market Trends, with implications for investors, developers, and residents alike.

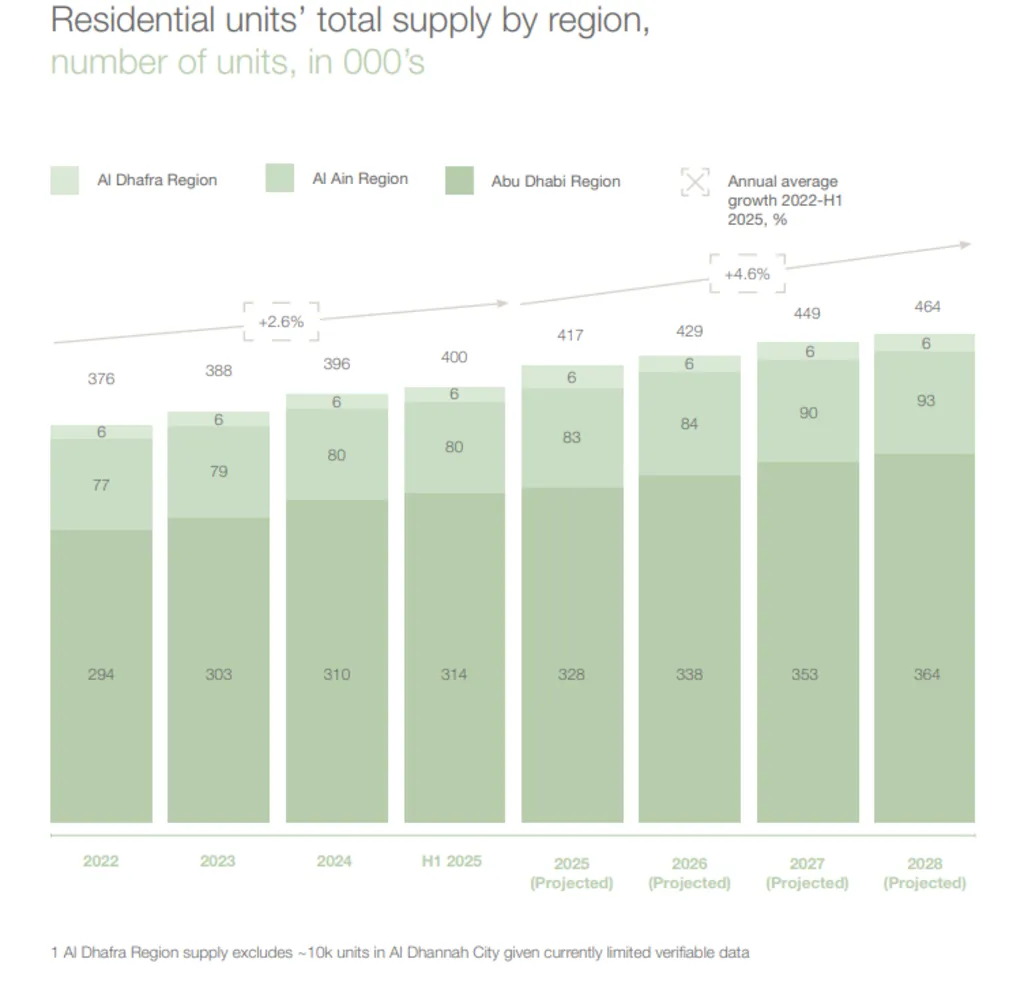

6% Demand Growth Outpaces 2.6% Supply Expansion Across the Emirate

Between 2022 and H1 2025, residential demand across Abu Dhabi grew at an average annual rate of 5.8%, driven by population growth, foreign direct investment, and a shift toward high-quality housing. In contrast, supply expanded at just 2.6% annually, reaching approximately 400,000 units by mid-2025. This imbalance is most pronounced in the Abu Dhabi Region, which holds 78% of the emirate’s residential stock and saw demand grow by 6% versus a 2.7% supply increase.

Investment Zones Represent 21% of Abu Dhabi Region’s Residential Stock

Designated investment zones, where foreign nationals can own property freehold account for 66,000 units or 21% of the Abu Dhabi Region’s supply. These zones are central to Abu Dhabi Living & Real-Estate Market Trends, attracting global capital and driving premium development. Notably, 50% of projected future supply is concentrated in these zones, with seven major developers responsible for 77% of the pipeline through 2028.

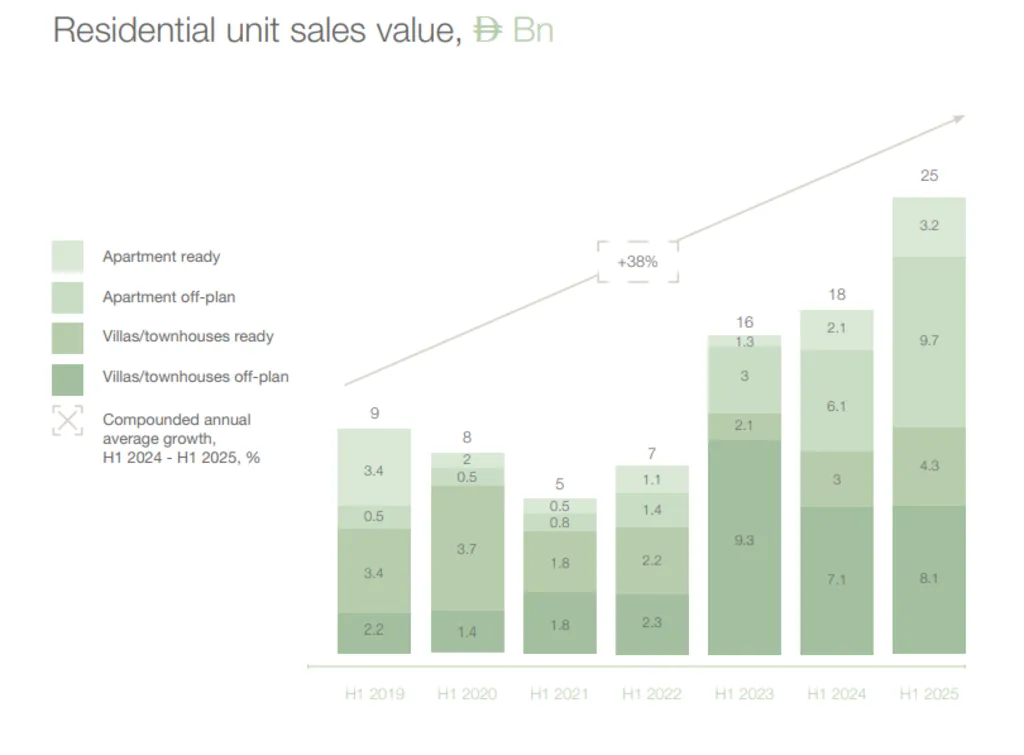

Residential Sales Hit AED25 Billion in H1 2025, Up 38% YoY

Sales activity surged in H1 2025, with residential unit transactions reaching AED25 billion, a 38% increase over H1 2024. This growth was fueled by expat and offshore buyers, who accounted for 65% of total residential sales. Cash transactions dominated, comprising 81% of deals, underscoring market resilience and investor confidence. The top 10 projects contributed 45% of total sales value, with Al Hidayriyyat Island alone generating AED2.1 billion.

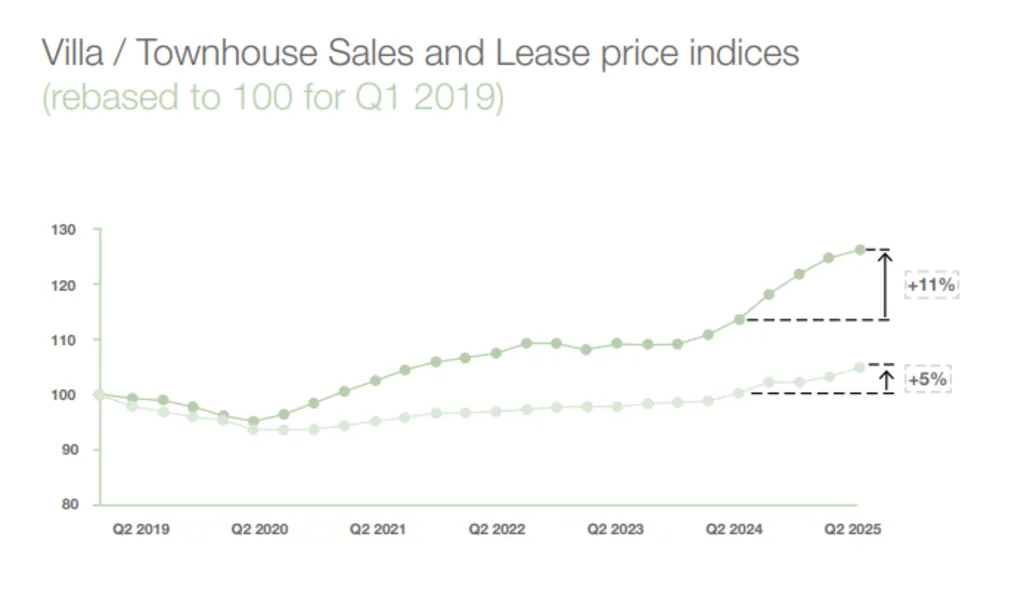

Leasing Market Grows 6% in Value, Led by Luxury Apartments

The leasing segment echoed the emirate’s economic momentum, with total lease value reaching AED8.2 billion in H1 2025. Apartment rental prices rose 14% year-over-year, outpacing the 5% increase for villas and townhouses. This divergence reflects a sharp uptick in demand for high-end apartments, particularly in waterfront and master-planned communities. Abu Dhabi Region drove 92% of total lease value, reinforcing its role as the emirate’s residential core.

Price Indices Show 14% Growth for Apartments, 11% for Villas

From Q2 2024 to Q2 2025, apartment sale prices climbed 14%, while villa and townhouse prices rose 11%. Lease rates followed a similar trajectory, with apartments seeing a 12% increase. These trends highlight the premium placed on urban living and the growing appetite for upscale residential offerings, key themes within Abu Dhabi Living & Real-Estate Market Trends.

ADREC’s Role in Shaping a Transparent, Data-Driven Ecosystem

The Abu Dhabi Real Estate Centre (ADREC), established in late 2023, has emerged as a pivotal force in shaping the market. Through initiatives like the Madhmoun MLS platform and legal reforms enhancing compliance and investor protection, ADREC is fostering a more transparent and responsive environment. Its mandate spans the entire real estate value chain, from development oversight to dispute resolution, ensuring that Abu Dhabi Living & Real-Estate Market Trends are grounded in trust and innovation.