$596M in Greenfield Projects Signal Strategic Shift in Abu Dhabi FDI Trends

In the first half of 2025, Abu Dhabi attracted 42 greenfield Foreign Direct Investment (FDI) projects totaling $595.8 million. This figure, while modest compared to Dubai’s $3.03 billion, reflects a deliberate pivot toward diversified, high-value sectors. The capital’s FDI strategy is increasingly aligned with sustainability, technology, and regional leadership—hallmarks of the broader UAE investment narrative.

UAE’s $5.42B FDI Boom Led by Dubai, Sharjah, and Abu Dhabi

Across the UAE, 613 greenfield projects drew $5.42 billion in capital inflows. Dubai led with 526 projects, while Sharjah, despite hosting only 24, secured $1.47 billion—thanks to large-scale developments like a $953 million mixed-use real estate venture. Abu Dhabi’s $596 million contribution underscores its growing role in sectoral diversification, especially in communications and AI infrastructure.

Communications Sector Drives $359.5M in Tech-Focused FDI

Abu Dhabi FDI Trends in 2025 reveal a strong tilt toward tech-driven investments. The communications sector alone attracted $359.5 million across 16 projects, including sovereign cloud and AI infrastructure initiatives. Microsoft’s collaboration with Core42, a G42 subsidiary, exemplifies the emirate’s ambition to become the world’s first AI-native government by 2027.

Free Zones Host 17.5% of Projects, Attract 30% of Capital

Free zones continue to be magnets for capital-intensive ventures. Though they hosted just 17.5% of total projects, they accounted for nearly $1.62 billion—almost 30% of total FDI. Jebel Ali Free Zone led with $474.1 million, followed by Dubai South ($280.9M), Al Hamra Industrial Zone ($127.1M), and Dubai Industrial City ($114.4M). These zones offer 100% foreign ownership, tax exemptions, and streamlined licensing, making them ideal for manufacturing, logistics, and tech operations.

Real Estate and Construction Secure $2.17B Despite Low Project Count

While real estate saw only 29 projects, it led in capital investment with $1.05 billion. A single $953 million mixed-use development in Sharjah drove most of this figure. Construction, with just three projects, attracted $1.12 billion—highlighting the UAE’s appetite for large-scale infrastructure and urban transformation.

Manufacturing and Sustainability Investments Top $1B

Manufacturing drew $1.06 billion across 22 projects, focusing on automotive, chemicals, and advanced materials. Sustainability also emerged as a key theme, with notable investments like a $346.6 million polyethylene film recycling plant in Sharjah and a $127.1 million adhesives facility in RAK’s Al Hamra Industrial Zone.

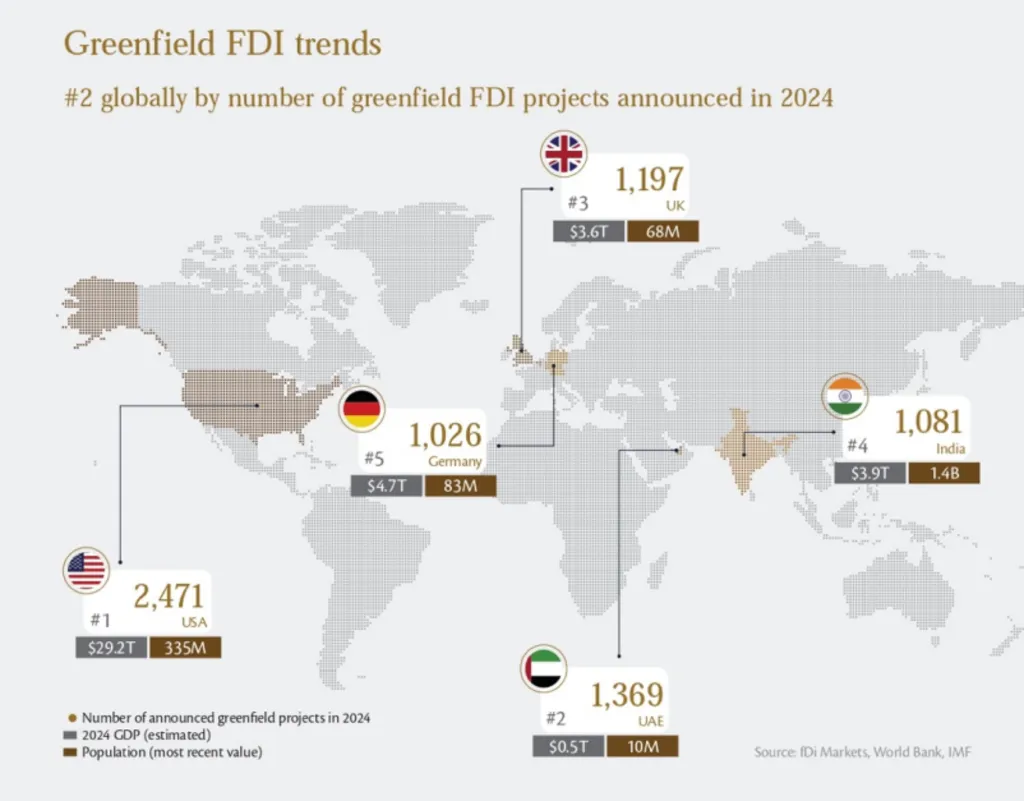

UK, India, and US Lead in Project Count; Kuwait Tops Capital Value

The UK led in project count with 120 greenfield ventures, followed by India (101) and the US (94). However, Kuwait topped capital investment with $955.7 million from just three projects—driven largely by its Sharjah real estate investment. The US followed with $889.5 million, and India with $677.9 million. China and Italy also made notable contributions, investing $413.2 million and $387.6 million respectively.

Abu Dhabi’s Diversification Strategy Gains Momentum

Abu Dhabi FDI Trends in 2025 reflect a strategic shift toward tech, sustainability, and regional headquarters. The emirate’s $596 million in greenfield investments may be smaller in volume, but they are high in strategic value—positioning Abu Dhabi as a rising force in the UAE’s diversified economic future.

Also Read: Non-Oil Export Expansion: Abu Dhabi’s Path to Sustainable Growth