5GW Vision: Abu Dhabi’s Data Center Ambition Outpaces Global Peers

The UAE is rapidly emerging as a global digital infrastructure powerhouse, with Abu Dhabi at the forefront of this transformation. As of 2024, the country hosts over 250MW of live data center capacity, and an additional 500MW is actively under development. While this figure represents the national total, Abu Dhabi Data Center Growth is leading the charge—both in scale and strategic vision.

The emirate’s flagship project, Stargate UAE, is a 5GW hyperscale campus backed by OpenAI, Oracle, and Nvidia. Once fully operational, it will be one of the largest AI-focused data center clusters in the world. This positions Abu Dhabi not just as a regional leader, but as a serious contender on the global stage.

Power Availability and Preleasing: Abu Dhabi’s Competitive Edge

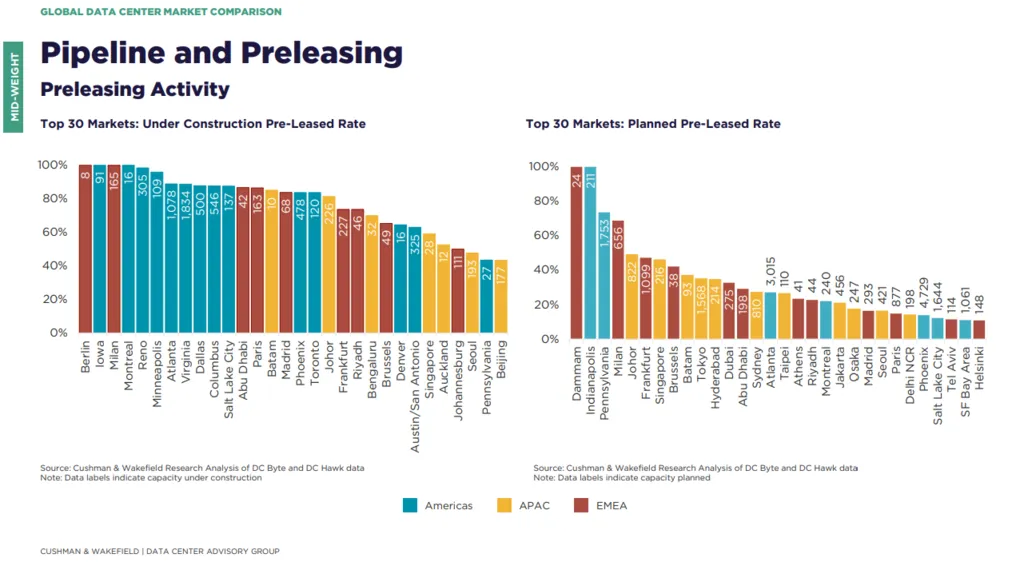

Power availability remains the most critical factor in global data center site selection, and Abu Dhabi is capitalizing on this. While many established markets like Tokyo and London face grid constraints and long power delivery timelines, Abu Dhabi offers a more agile and scalable alternative. The emirate boasts one of the highest preleasing rates among emerging markets, with over 70% of under-construction capacity already committed.

This level of demand signals more than just speculative interest—it reflects real, unmet needs from hyperscalers and cloud providers. Abu Dhabi’s ability to deliver power at scale, combined with its investment in renewable energy and transitional power strategies, makes it a rare find in today’s constrained global landscape.

Land and Fiber: Abu Dhabi Offers Room to Scale

Unlike many urbanized data center hubs, Abu Dhabi benefits from abundant land availability. This allows for the development of large-scale, phased campuses that can accommodate hyperscale deployments over time. Globally, land constraints have become a bottleneck in cities like Amsterdam and Frankfurt, where regulatory hurdles and high costs limit expansion.

Abu Dhabi also ranks among the top markets for fiber connectivity, with low-latency access to regional and international networks. This is critical for AI and cloud workloads, which require high-speed, redundant connections to function efficiently. The emirate’s robust fiber infrastructure, combined with its strategic location between Europe and Asia, enhances its appeal as a digital crossroads.

Institutional Capital and Cloud Expansion Fuel Abu Dhabi Data Center Growth

The surge in Abu Dhabi data center growth is backed by unprecedented levels of institutional capital. ADQ and Energy Capital Partners are investing $25 billion into power infrastructure, while Microsoft, MGX, and BlackRock are supporting a $30 billion AI-driven initiative. These investments are not only funding hyperscale builds but also enabling the development of supporting infrastructure in parallel.

Cloud service providers like AWS, Alibaba, and Equinix are expanding their footprint in the UAE, while local leaders such as Khazna Data Centers are delivering AI-optimized facilities like the 100MW campus in Ajman. With over 59% market share, Khazna is setting the pace for enterprise and hyperscale deployments alike.

Global Context: Abu Dhabi’s Growth Outpaces Traditional Markets

When compared to global benchmarks, Abu Dhabi’s trajectory is striking. While established markets like Virginia and Phoenix still dominate in total capacity, they face rising land prices, power shortages, and regulatory pushback. In contrast, Abu Dhabi offers a rare combination of operational reliability, future scalability, and investor confidence.

As the global race for AI and cloud infrastructure intensifies, Abu Dhabi is no longer just catching up—it’s setting the pace. With a 500MW development pipeline and a 5GW vision on the horizon, the Abu Dhabi data center growth story is one of the most compelling in the world today.