How is Abu Dhabi integrating AI and robotics into its Construction 4.0 agenda?

Abu Dhabi’s Construction 4.0 Push: AI, Robotics & Prefab in Economic Cities

In the post-oil economy narrative of the UAE, Abu Dhabi is increasingly positioning itself not just as a financial or industrial hub, but as a pioneer in Construction 4.0. With the emergence of high-profile economic zones like KEZAD, Masdar City, and the Industrial City of Abu Dhabi (ICAD), the capital is pushing forward an agenda that blends AI, robotics, digital twins, and prefabrication to rewire the entire construction value chain.

AI and Robotics: The Digital Core of Construction 4.0

Abu Dhabi’s Construction 4.0 strategy is anchored in the automation of core tasks and the datafication of the build environment. Local authorities, particularly the Department of Municipalities and Transport (DMT), have initiated pilot programs using machine learning models to optimize site planning, reduce material waste, and predict structural stress during various construction phases.

Aldar Properties, one of Abu Dhabi’s leading developers, is already embedding AI-powered project management tools across major housing and mixed-use developments. In 2023, Aldar partnered with IBM and Oracle Aconex to deploy predictive analytics platforms to track site progress, worker efficiency, and schedule deviations in real time. Meanwhile, robotic bricklaying, 3D printing of concrete elements, and drone-based site inspections are gaining ground in strategic developments such as Masdar City Phase 2 and parts of KEZAD's industrial expansion zones. The UAE Ministry of Energy and Infrastructure has also endorsed Boston Dynamics Spot—a robot designed for autonomous site inspections—to enhance worker safety in constrained or hazardous construction environments.

What role does prefab construction play in fast-tracking economic city projects?

Prefabrication: Building at the Speed of Vision

Prefab and modular construction is fast becoming Abu Dhabi’s secret weapon for delivering mega-projects at scale and speed. In KEZAD and ICAD, China State Construction Engineering Corporation (CSCEC) and Modular Assembly Systems have rolled out full-scale prefabrication yards producing modular office blocks, worker accommodations, and warehouse shells.

Data from the Abu Dhabi Department of Economic Development (ADDED) shows that modular methods reduce construction timelines by up to 35% and project cost overruns by 15–20%. In projects aligned with the "Make it in the Emirates" initiative, prefabricated components are now required to meet localization thresholds, thereby creating a dual benefit of speed and industrial stimulation.

A striking case is the Al Reem Mall, completed in late 2023, which used over 40% of its structural and MEP systems prefabricated off-site. Not only did this reduce waste, but it also shaved nearly four months off the original construction schedule.

How are labor dynamics shifting due to automation in construction processes?

Labor Market Recalibration: From Manual to Machine-Integrated

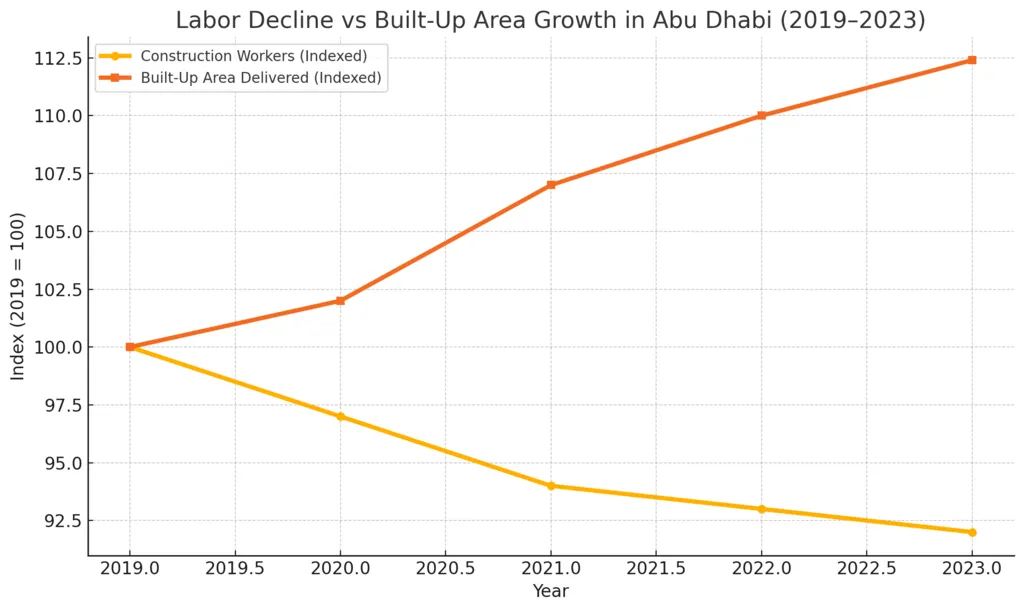

The UAE’s construction sector has long been labor-intensive. But automation is changing the equation. According to data from Oxford Economics and the Abu Dhabi Statistics Centre, the total number of on-site construction workers in Abu Dhabi declined by 8.2% from 2019 to 2023, even as total built-up area deliveries increased by 12.4% over the same period.

This doesn’t mean job loss—it means job transformation. Skilled labor demand is shifting toward BIM specialists, drone operators, prefab assembly technicians, and AI-integrated logistics coordinators. Training centers like ACTVET and the Abu Dhabi Centre for Technical and Vocational Education have introduced new Construction 4.0 curricula to address this.

What are the environmental and cost benefits of digitalized construction in Abu Dhabi?

Environmental and Financial ROI of Digitalization

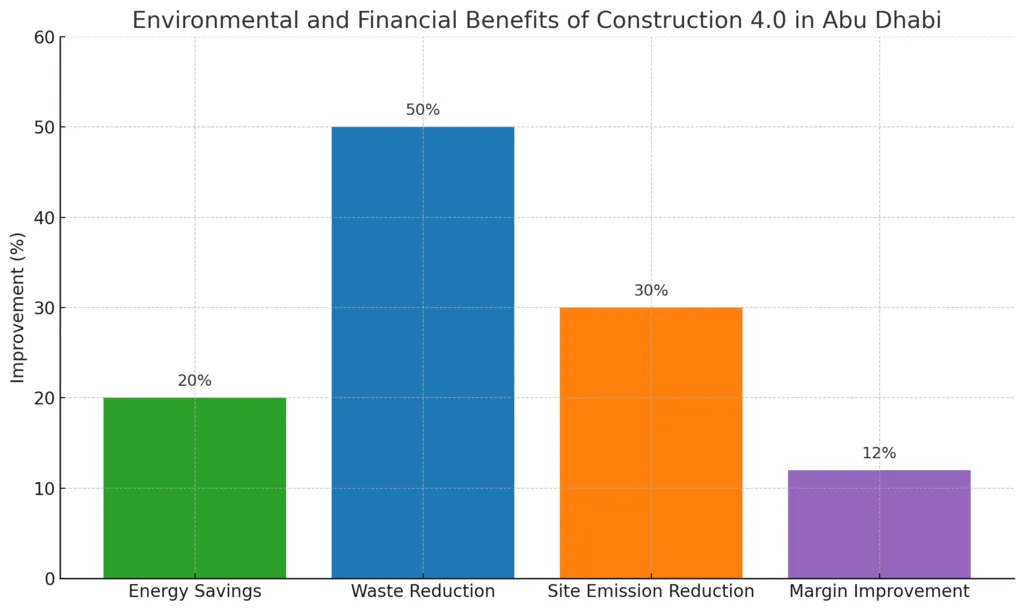

Abu Dhabi’s climate conditions—extreme heat, dust, and humidity—make resource optimization a critical imperative. Digital construction techniques, including AI-based energy modeling and digital twins for HVAC and utility systems, are reducing both energy usage and carbon emissions.

A 2023 report by Masdar and Buro Happold revealed that buildings constructed using smart energy modeling consume 17–22% less energy than traditionally built equivalents in the UAE. Meanwhile, prefabrication reduces on-site waste by up to 50%, and site disruption (including emissions from machinery and transport) by over 30%. On the financial side, Construction 4.0 can improve profit margins by 10–15%, largely by reducing rework, schedule slips, and material loss, according to a 2024 McKinsey UAE construction sector benchmark.

Which pilot projects or zones are leading the Construction 4.0 transformation?

Zones Leading the Transformation

Abu Dhabi’s Construction 4.0 adoption is not uniform—it is being led by high-value, innovation-driven zones.

- Masdar City is integrating AI and prefab into sustainable building certification frameworks, positioning itself as the region’s green R&D construction lab.

- KEZAD is emerging as the largest hub for prefab and industrialized construction in the Gulf, with 4.5 million sqm under development.

- Reem Island and Saadiyat Grove by Aldar are testing drone-monitoring systems and smart BIM integration for luxury urban developments.

- The Zayed Smart City Masterplan outlines a roadmap for integrating AI, IoT, and robotics into every facet of infrastructure deployment by 2030.

This transformation is not theoretical—it is happening in real time. Abu Dhabi has taken a national-level ambition (the UAE’s Industrial Strategy and Vision 2031) and translated it into localized, high-impact execution. The result: a construction sector that is more productive, more sustainable, and increasingly exportable.

The next five years will define whether Construction 4.0 in Abu Dhabi becomes a new industrial pillar or remains a set of isolated pilots. Based on current momentum, the former is more likely. For developers, technology firms, and investors alike, the message is clear: the future of building in the Middle East is being written in Abu Dhabi.