What strategies are driving Abu Dhabi’s investment in the life sciences sector?

Strategic Investment in Life Sciences

Over the past five years, Abu Dhabi has undergone a deliberate and strategic transformation aimed at building a globally competitive life sciences sector. What was once a policy ambition is now translating into real infrastructure, meaningful partnerships, and scalable job creation. In a post-pandemic world, governments are rethinking industrial resilience, sovereign health capacity, and economic diversification. Abu Dhabi is ahead of that curve—and its progress deserves attention

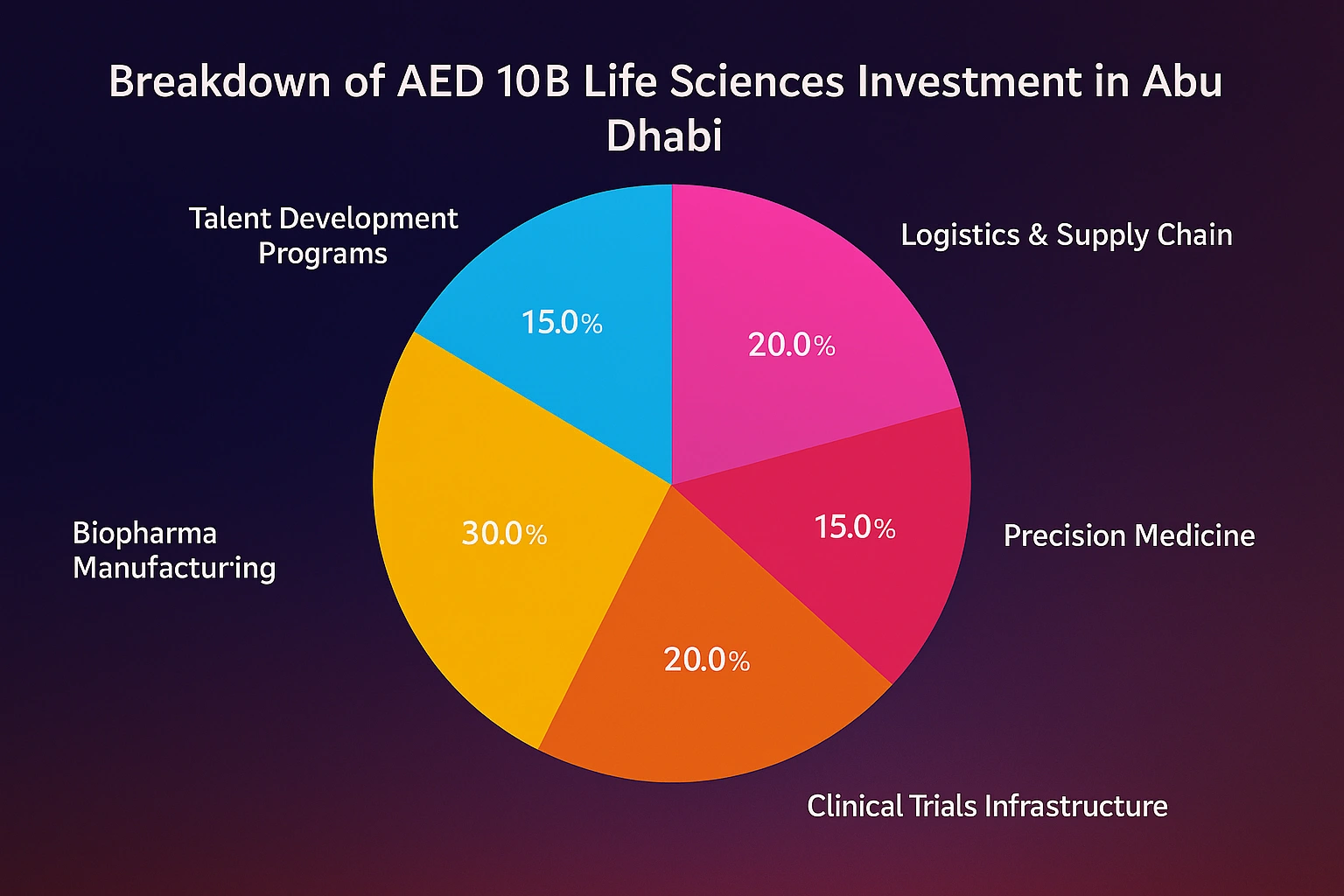

Vision and Funding Commitments

The Emirate’s investment in life sciences is being driven by a blend of sovereign strategy and market foresight. Anchored in the Abu Dhabi Industrial Strategy and the Department of Health’s Life Sciences Roadmap, the government has committed to making life sciences one of six priority industrial sectors. This is backed by an allocation of AED 10 billion to support industrial transformation, including biopharma manufacturing, clinical research infrastructure, and precision medicine capabilities. The Department of Economic Development (ADDED) has also allocated AED 500 million specifically for life sciences-focused innovation districts, designed to attract both global anchor tenants and regional scale-ups. Importantly, this isn't about short-term stimulus. It is about building a durable, high-value, knowledge-based pillar of the UAE economy.

How is the biopharma industry expected to contribute to job creation by 2035?

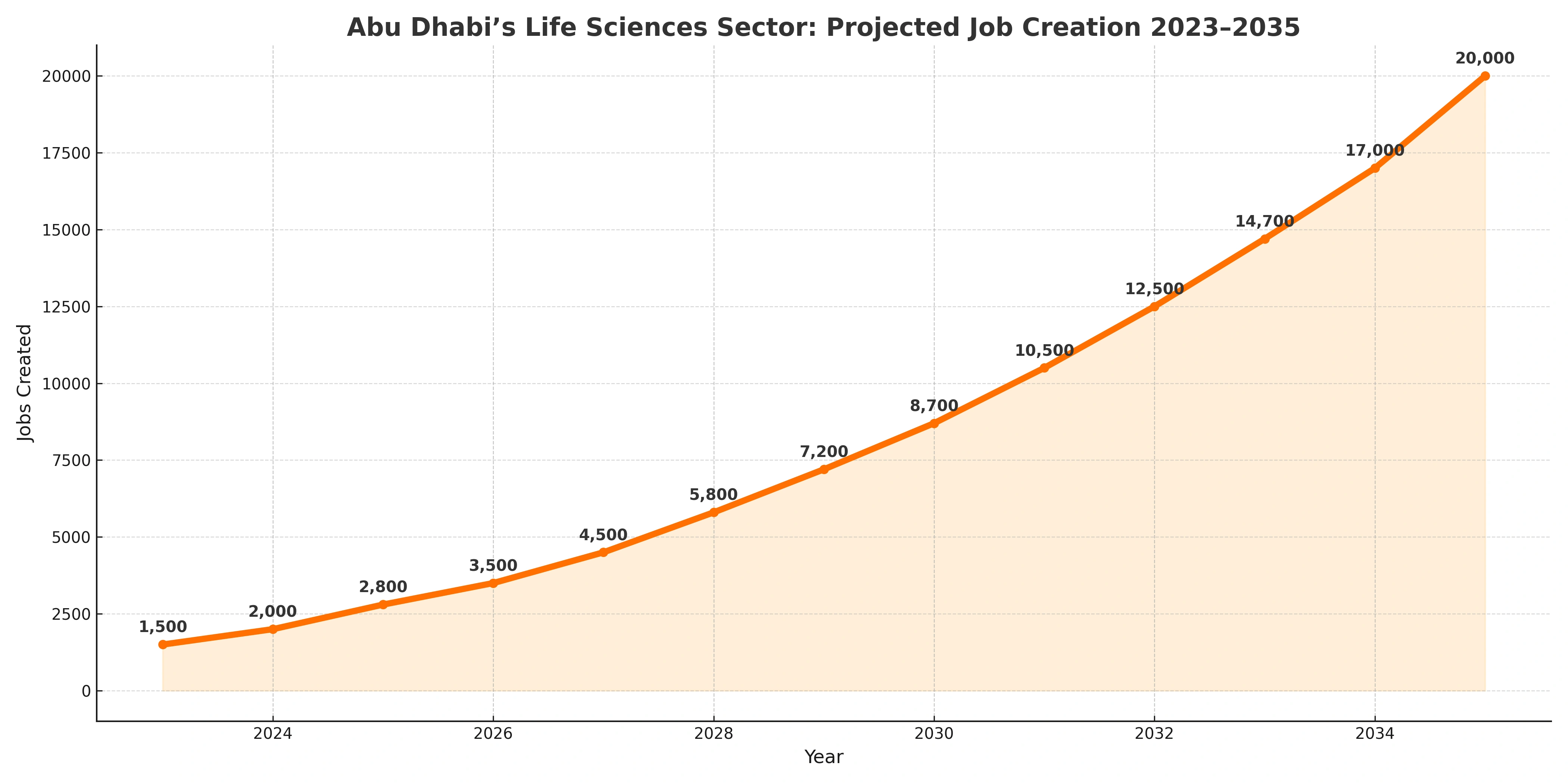

Biopharma at the Core of Job Creation

The biopharma segment stands at the heart of Abu Dhabi’s job creation thesis. According to the Department of Economic Development and the Department of Health, the Emirate is targeting the creation of 20,000 skilled jobs in life sciences by 2035. These jobs are not only administrative or clerical; they are deeply technical and multidisciplinary. They include roles in pharmaceutical R&D, clinical trial management, quality assurance, process engineering, and advanced biologics manufacturing. Mubadala Health and G42 Healthcare are already leading this effort with significant hires in genomics, bioinformatics, and molecular diagnostics. G42’s Biogenix Labs, for instance, became the region’s largest COVID-19 testing facility during the pandemic and has since pivoted into full-spectrum genomic analysis.

Global Partnerships and Private Sector Expansion

Job creation will not be limited to public entities. Global players are scaling up as well. Pfizer and AstraZeneca have already expanded their footprint in Abu Dhabi, engaging in workforce development partnerships and supply chain localization. The construction of a sterile injectable drug plant by the UAE’s Globalpharma, in collaboration with Chinese firm Sinopharm CNBG, is one example of how manufacturing, IP transfer, and employment are converging in a practical model. Merck, Sanofi, and Johnson & Johnson have also signaled interest in establishing R&D and market access units in the region, especially through partnerships with ADGM and Hub71.

What infrastructure and policy support are enabling life sciences innovation?

Infrastructure and Regulatory Foundations

Abu Dhabi’s life sciences ecosystem is being enabled by a purpose-built regulatory and infrastructure foundation. KEZAD (Khalifa Economic Zones) has established GMP-certified zones designed for biotech and medtech manufacturing, while Abu Dhabi Ports has developed temperature-controlled logistics corridors to support pharmaceutical distribution. Meanwhile, the Clinical Research Office under the Department of Health has streamlined trial approvals and introduced a unified Institutional Review Board (IRB) system, making Abu Dhabi one of the most trial-friendly jurisdictions in the MENA region. In 2023, the number of active clinical trials in the Emirate reached 85, with over 10 international pharmaceutical sponsors involved, including Novartis and Roche.

How are local universities and global pharma firms collaborating in R&D?

Academic-Industry Collaboration and Genomic Innovation

On the innovation side, partnerships between academia and industry are gaining traction. Khalifa University and UAE University are collaborating with global firms such as Sanofi, Roche, and AstraZeneca to co-develop translational research programs and genomics platforms. Through initiatives like the Emirati Genome Project, more than 200,000 Emiratis have had their DNA sequenced to date, creating one of the world’s richest national gene databases. This is not only a scientific asset—it is an economic one. Pharmaceutical companies looking to develop regionally targeted therapies are now looking at Abu Dhabi as a unique clinical and data-rich environment. Additionally, the Abu Dhabi Stem Cell Center (ADSCC) has been expanding its clinical and regenerative medicine programs, offering cellular therapy and CAR-T programs that are rare in the region.

Can Abu Dhabi position itself as a regional hub for life sciences manufacturing and talent?

A Measurable Path to a Post-Oil Economy

Abu Dhabi’s potential to become a regional life sciences hub is not speculative. It is grounded in measurable progress. In 2023, life sciences exports from the UAE crossed AED 2.5 billion, with 65% attributed to products manufactured in Abu Dhabi, according to the ADDED Annual Report 2024. The Emirate offers a rare combination: sovereign investment, strong regulatory alignment, modern logistics, deepening talent pools, and a stable business environment. Unlike other regional players where life sciences activity is either nascent or fragmented, Abu Dhabi is consolidating its advantages under a coherent national strategy.

While challenges remain—particularly in scaling local talent fast enough and competing with Asia-Pacific manufacturing costs—the trajectory is clear. Abu Dhabi is not just building factories and signing MoUs. It is cultivating an ecosystem. By 2035, the life sciences sector could represent a foundational pillar of the Emirate’s post-oil economy, and a benchmark for how small, high-capacity nations can lead in health innovation.

Sources: Department of Health Abu Dhabi, ADDED 2023 Industrial Strategy Reports, Mubadala Health Annual Review, G42 Healthcare Public Data, WAM Emirates News Agency, Hub71, KEZAD, Globalpharma Press Releases.