Abu Dhabi Hydrogen Fueling Stations: A Strategic $3.8M Opportunity in Clean Mobility Infrastructure

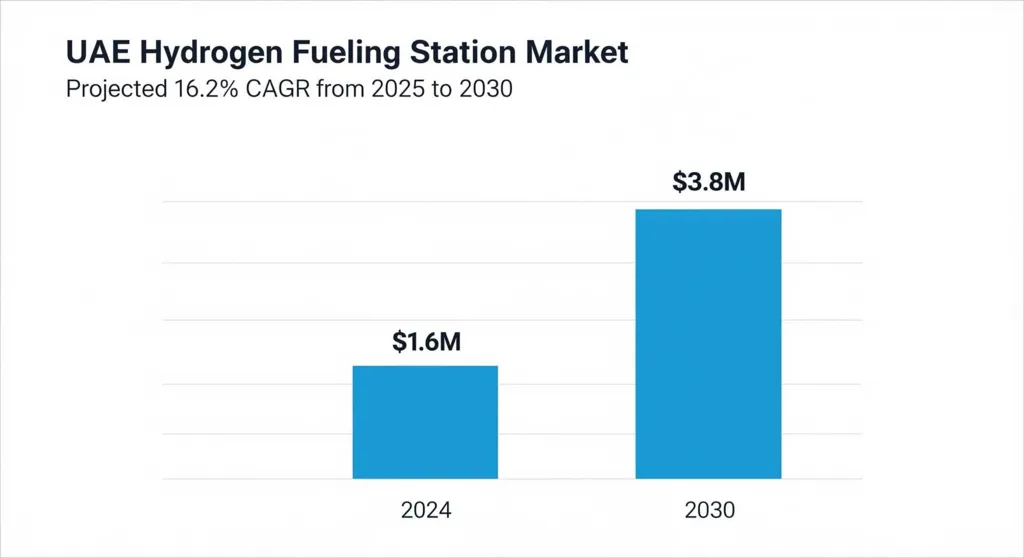

As global energy markets pivot toward decarbonization, Abu Dhabi is quietly positioning itself as a hydrogen mobility hub within the UAE’s broader clean energy transition. While the UAE’s hydrogen fueling station market is projected to reach USD 3.8 million by 2030, Abu Dhabi’s infrastructure, policy alignment, and early deployment of green hydrogen assets make it a compelling focal point for enterprise investment.

Meeting climate targets is one goal, but the larger opportunity is building a scalable and commercially viable fueling network for future transport systems. For companies in energy, logistics, infrastructure, and mobility, Abu Dhabi Hydrogen Fueling Stations offer a strong entry point into the region’s growing hydrogen economy.

Infrastructure Advantage: Centralized Production, Distributed Reach

Abu Dhabi’s infrastructure edge begins with its centralized green hydrogen production facility in Masdar, operational since 2021. Powered by solar photovoltaics, the plant uses water electrolysis to produce zero-emission hydrogen; an essential input for fuel cell electric vehicles (FCEVs). This centralized model enables efficient distribution via tube trailers to strategically placed stations across the emirate.

Each station is designed to dispense 200 kg of hydrogen per day, enough to serve up to 160 fuel cell vehicles. For enterprises, this means predictable throughput, standardized design, and scalable logistics—critical factors for evaluating ROI on station deployment, fleet conversion, or supply chain integration.

Strategic Placement: Highway-Centric Models Reduce Capital Load

Unlike traditional fueling networks that rely on dense urban clustering, Abu Dhabi’s approach leverages highway-centric placement to maximize coverage with minimal infrastructure. Modeling studies using the Set Cover Model (SCM) and Flow Intercept Location Model (FILM) show that full highway coverage can be achieved with as few as 2–5 hydrogen stations, depending on vehicle range[*].

For example, a 500 km driving range scenario requires only two stations to span the emirate’s longest highway segments. This data-driven planning reduces upfront capital requirements while ensuring service reliability for inter-emirate travel. Enterprises looking to deploy or support hydrogen fleets can benefit from lower infrastructure costs and faster time-to-market.

Market Dynamics: Small Stations Lead in Scalability

While medium-sized stations generated the highest revenue in the UAE in 2024, small stations are forecasted to be the fastest-growing segment. In Abu Dhabi, their compact footprint and lower setup costs make them ideal for urban and peri-urban deployment. For energy companies and infrastructure developers, small stations offer modularity, faster permitting, and easier integration with existing assets.

This scalability is especially relevant for hybrid station models, where electric vehicle (EV) chargers are co-located with hydrogen dispensers at existing gas stations. Abu Dhabi’s use of the Maximum Coverage Location Model (MCLM) to optimize such placements² opens the door for multi-fuel infrastructure partnerships.

Abu Dhabi’s Role in a 0.2% Global Market Share

In 2024, the UAE accounted for just 0.2% of the global hydrogen fueling station market[*]. But Abu Dhabi is projected to lead the Middle East & Africa region in revenue by 2030, thanks to its early infrastructure investments and policy alignment under the National Hydrogen Strategy 2050.

For enterprises, this means first-mover advantage in a market that’s still underdeveloped but rapidly gaining momentum. Whether you're a hydrogen producer, station operator, fleet manager, or technology provider, Abu Dhabi offers a stable regulatory environment, growing demand signals, and a clear roadmap for expansion.

Enterprise Implications: What to Watch and Where to Act

- Fleet Electrification: Logistics and transport companies can begin transitioning long-haul fleets to FCEVs, supported by Abu Dhabi’s highway station network.

- Station Development: Infrastructure firms can partner with ADNOC or Masdar to co-develop small and medium-sized stations, leveraging existing land assets.

- Technology Integration: AI, IoT, and energy management platforms can be embedded into station operations for predictive maintenance and dynamic pricing.

- Cross-sector Collaboration: Utilities, real estate developers, and mobility startups can co-invest in hybrid stations that serve both hydrogen and EV users.

Summary: Abu Dhabi Hydrogen Fueling Stations as a Commercial Catalyst

Abu Dhabi is setting a model for clean mobility infrastructure. With centralized green hydrogen production, optimized station placement, and scalable infrastructure models, the emirate offers a commercially viable path to hydrogen mobility. For enterprises ready to invest in the future of transport, Abu Dhabi Hydrogen Fueling Stations are more than a policy milestone—they’re a market opportunity.

Also Read: Sustainable Travel in Desert Kingdom | Bikes & Hydrogen Plan in KSA

¹ Alshehhi, H., Corona, B.H., Zaiter, I., Mezher, T., & Mayyas, A. (2025). Strategic placement of alternative fueling stations in the UAE. Scientific Reports, 15, Article 11699. https://doi.org/10.1038/s41598-025-95701-8