Analyzing the Latest Trends in Abu Dhabi’s Real Estate Market

Abu Dhabi’s real estate market is experiencing a remarkable surge, driven by significant foreign direct investment (FDI) and a growing demand for both affordable and luxury properties. The latest H1 2024 data highlights notable increases in asking prices for properties across various segments, reflecting heightened market activity and investor interest. This article delves into the current Real Estate Market Trends, key drivers, and emerging investment opportunities in Abu Dhabi, providing a comprehensive outlook for the future.

Trends in Property Sales

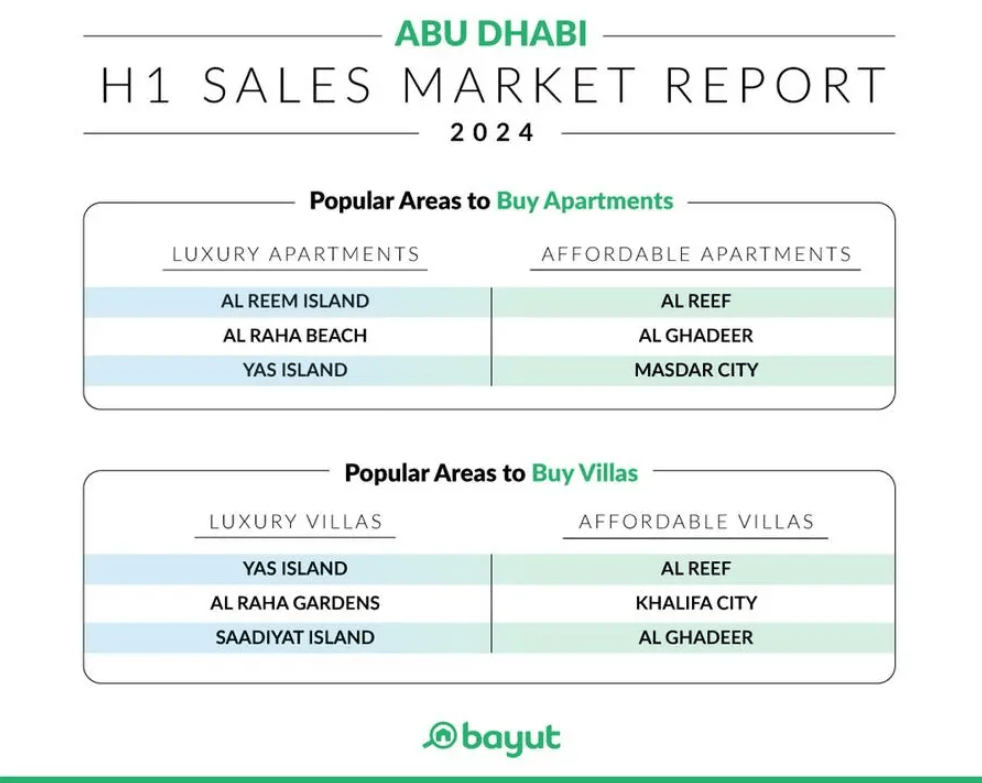

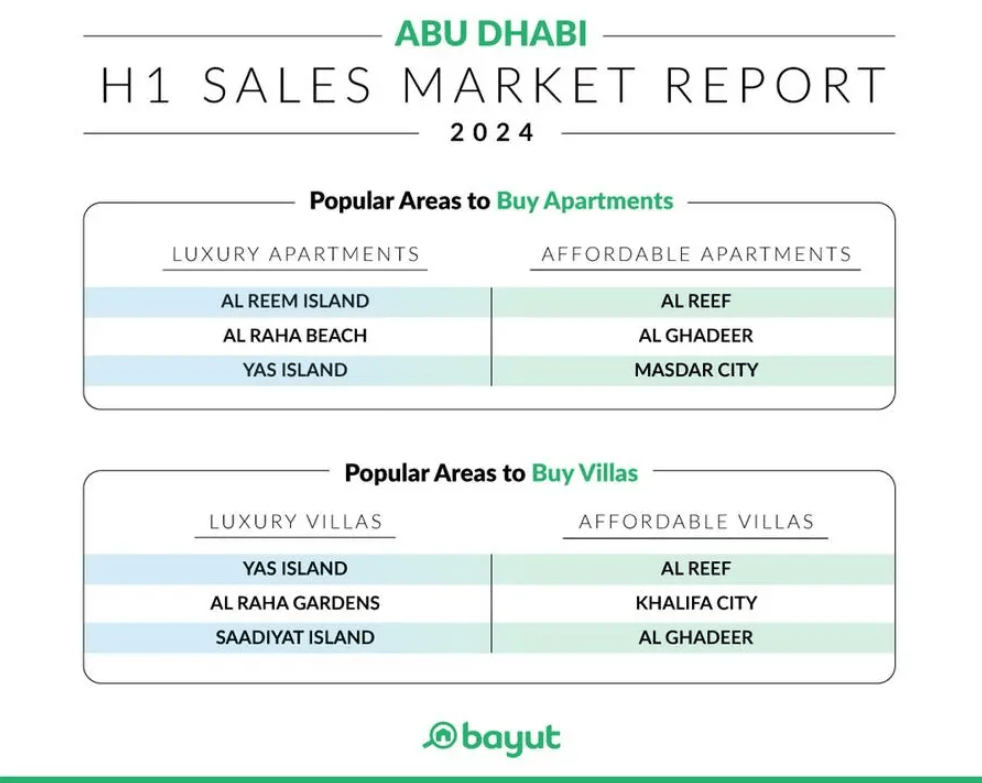

The demand for high-quality properties in Abu Dhabi has led to substantial price hikes in both affordable and luxury segments. Affordable apartments in Al Reef and Al Ghadeer have emerged as popular choices, while luxury apartments in Al Reem Island and Al Raha Beach continue to attract interest. The villa market has also seen a surge, with budget-friendly villas in Al Reef and Khalifa City and luxury villas in Yas Island and Saadiyat Island being highly sought after.

Data reveals that the average price-per-square-foot for luxury villas in popular residential areas rose by up to 10% in the first half of 2024. Yas Island experienced a notable increase of 10.3%, while Saadiyat Island recorded the highest appreciation of 6% for luxury apartments. The affordable segment also witnessed price increases, with apartments in Al Ghadeer seeing a significant 9.5% rise.

Investment Opportunities

The current Real Estate Market Trends indicate lucrative investment opportunities in both affordable and luxury segments. Al Ghadeer, for instance, offers a high projected return on investment (ROI) of 8.52% for affordable apartments, making it an attractive option for budget-conscious investors. Similarly, luxury villas in Yas Island provide an impressive ROI of 6.89%, appealing to high-net-worth individuals (HNWIs) and international investors.

Off-plan projects have also gained traction, with affordable developments like Royal Park and Bloom Living attracting significant interest. In the luxury segment, off-plan developments in Yas Bay, City of Lights, and Saadiyat Cultural District are favored by investors seeking premium properties.

Trends in Property Rentals

The rental market in Abu Dhabi is equally dynamic, with strong demand driving price increases in both affordable and luxury segments. Popular areas for affordable apartment rentals include Khalifa City and Al Khalidiyah, while Mohammed Bin Zayed City (MBZ City) and Khalifa City are top choices for affordable villas. In the luxury segment, Al Reem Island and Al Raha Beach are preferred locations for renting high-end apartments, with Yas Island and Al Raha Gardens leading the rental market for luxury villas.

Rental prices for luxury apartments have surged by up to 21%, particularly in Saadiyat Island and Al Raha Beach communities. Affordable apartment rentals have also appreciated by more than 7% in areas like Al Muroor. The rental rates for affordable villas have seen a moderate increase of up to 7%, with upscale villas in Al Bateen experiencing rent hikes of up to 12%.

Future Outlook

The positive Real Estate Market Trends in Abu Dhabi suggest a promising outlook for the remainder of 2024 and beyond. The influx of foreign direct investment, coupled with government initiatives to enhance regulation and transparency, is expected to sustain the growth momentum. The diverse range of off-plan projects and the high demand for both affordable and luxury properties will likely continue to attract local and international investors.

Moreover, the continued development of infrastructure and amenities in key residential areas will further enhance the attractiveness of Abu Dhabi’s real estate market. With the government’s proactive approach and the steady increase in market activity, the capital city is poised to maintain its position as a prime destination for real estate investment.